Medical Debt Information for Consumers

Medical debt is an important issue in Los Angeles County, affecting one in nine adults. Angelenos across the county have bills they can’t pay for many reasons. They might have welcomed a new baby, found a worrying lump, had an accident, been rushed to an emergency room after a heart attack, or been prescribed expensive medication.

If you have a medical bill that you can’t pay or did not expect, help is available

- please see the

resources below. This page also includes

resources on how to access

no-cost or low-cost healthcare and guidance

on how to navigate the complex

medical billing and collections system.

To learn what the County of Los Angeles is doing to try to prevent and reduce medical debt for Angelenos, visit this page or sign up for our newsletter.

Get Help With a Medical Bill

New! If you live in District 1 of LA County and are having trouble paying your medical or dental bills, there is a debt relief program that may help you. Visit the Medical Debt Relief webpage to learn more.

Apply for free or discounted hospital services (charity care)

To look up a hospital's charity care and discount care policies and fill out an application, visit the California Department of Health Care Access and Information (HCAI) Hospital Fair Pricing Policy Lookup webpage.

This is how it works:

- You visit their website to see if you qualify for a discount or bill forgiveness and fill out the form.

- They prepare your application and send it to the hospital.

- They work with you and the hospital to try to get you medical debt relief.

Dollar For (website available in English and Spanish)

Legal Advice & Assistance

Neighborhood Legal Services of Los Angeles County (NLSLA) provides free legal services and healthcare referrals. NLSLA's

Health Consumer Center represents clients with medical debt and helps with questions about healthcare programs such as Medi-Cal, Medicare, Covered California, County health programs, and in-home supportive services.

Hotline: (800) 896-3202

nlsla.org/services/healthcare

Bet Tzedek provides free legal services related to medical debt for low-income individuals and families.

Hotline: (323) 939-0506

bettzedek.org/get-help

Health Consumer Alliance is a partnership of nonprofit legal services organizations across California that offer free assistance to consumers in understanding and navigating health insurance and medical debt.

Hotline: (888) 804-3536

healthconsumer.org

Consumer Counseling

File a complaint

To dispute a bill, make a complaint or express a concern about medical debt or health insurance, contact the DMHC. You can get information on your rights and protections as a consumer related to medical debt.

Hotline: (888) 466-2219

dmhc.ca.gov

California Department of Health Care Access and Information (HCAI)

If you think a hospital didn’t follow the rules for discount payments, free care, or debt collection, the

Hospital Bill Complaint Program may be able to help. You can send a complaint online or by mail.

You can also look up a hospital’s policies on charity care, discount care, discount payment, and debt collection policies on the HCAI Hospital Fair Pricing Policy Lookup webpage.

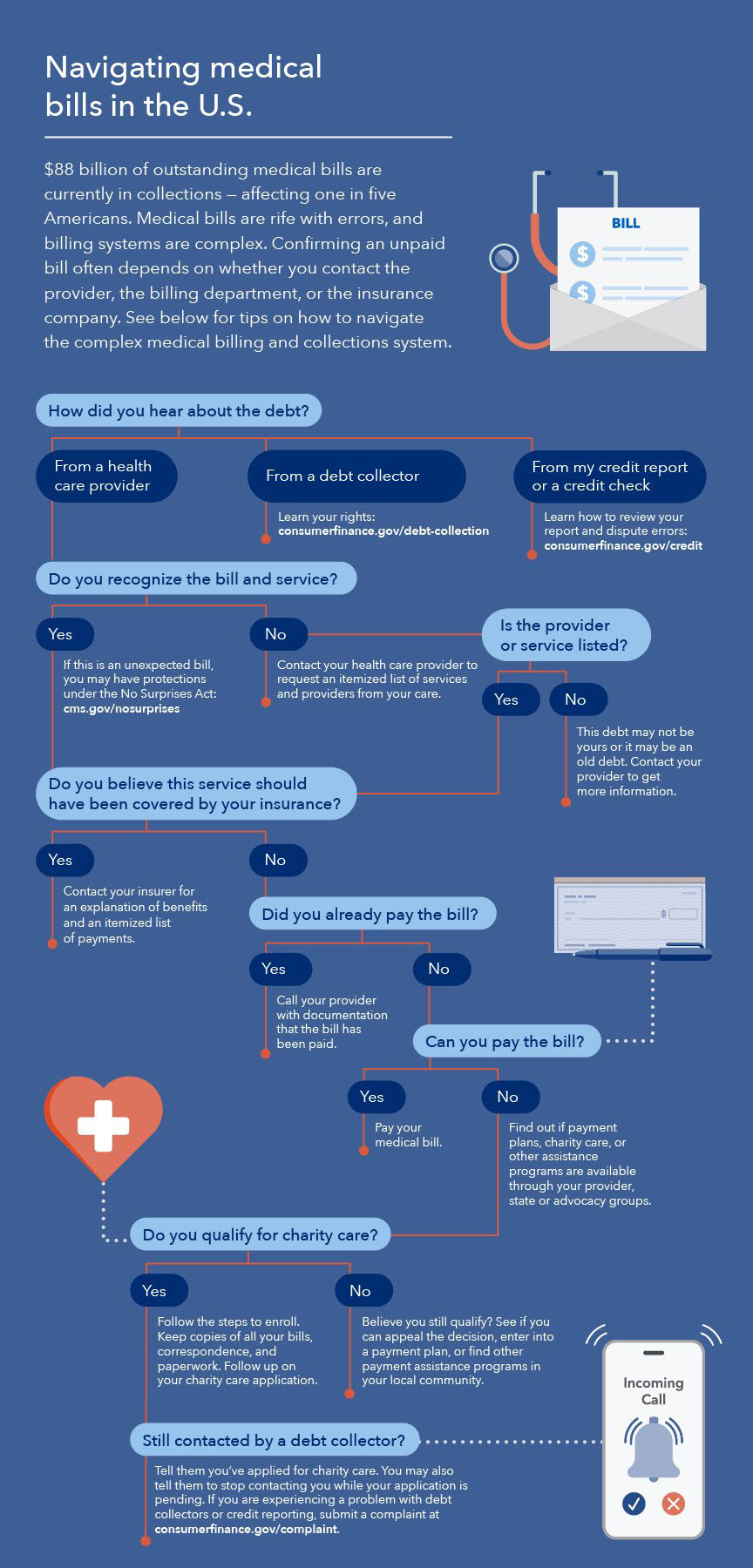

Tips for dealing with billing and collections

For more information about how to deal with medical bills and collections visit the Consumer Financial Protection Bureau.

Find Low-cost Care

Healthcare Providers

- The providers below adjust their fees based on income and family size. Even if you don't have insurance or can’t afford to pay, you will not be turned away. They can

also help you enroll in Medi-Cal.

- Federally qualified health centers: findahealthcenter.hrsa.gov

-

Department of Health Services:

Get Coverage and Care webpage

(844) 804-0055

- These agencies help families in LA County enroll in public and private health programs ph.lacounty.gov/mch/choi/CHOIContractorListEngSp.pdf.

- 211LA provides free information and referrals in multiple languages. Call 2-1-1 or use the online chat at 211la.org.

Medi-Cal

Medi-Cal is California’s Medicaid health care program that provides free or low-cost health coverage for many people with limited or no income. Medi-Cal benefits cover most medically necessary care, including doctor appointments, hospitalization, preventive care, pregnancy-related services, prescription drugs, vision care, and dental care.

In LA County, Medi-Cal is administered by the Department of Public Social Services (DPSS). Visit the DPSS Medi-Cal webpage (Spanish) to learn more and find out if you qualify.

IMPORTANT: Medi-Cal rules changed on January 1 2026, including a requirement to reapply every six months. Visit the DPSS Medi-Cal Changes webpage (Spanish) for details.

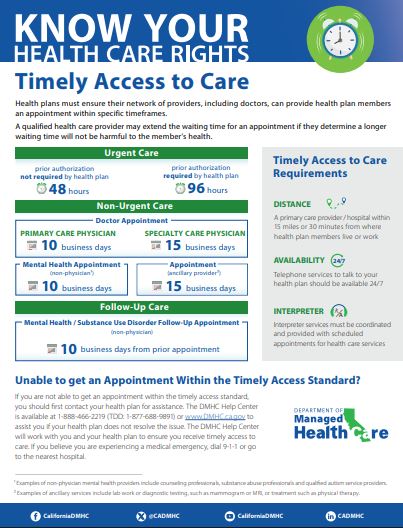

Know your rights in California

There are limits on how long you have to wait for a healthcare appointment, including for mental health. For example, for non-urgent care, you have the right to see a primary care physician within 10 business days and a specialty care physician within 15 business days. To learn more, including what do to if you are having problems getting a timely appointment, visit the California Department of Managed Healthcare Timely Access to Care webpage.

Health plan members, including Medicare and Medi-Cal recipients have many other rights, including to:

- Talk to a health professional at your health plan to decide if your health problem is urgent 24/7

- Get many preventive care services without a co-pay, co-insurance, or deductible

- Choose your own doctor and request continuity of care if your doctor or medical group leaves your health plan

- Change to another doctor or specialist in your health plan's network if you are not satisfied

- Get a second doctor's opinion

- Receive treatment for certain mental health conditions

- Receive services in your language

- Receive accessible services if you have a disability

- Understand your health problems and treatments

- See a written diagnosis (description of your health problem), get a copy of your records, and add your own notes to your records

- Keep your medical information private

- Give informed consent when you have a treatment

- Know why your health plan denies a service or treatment

- File a complaint or ask for an independent medical review if you have a problem with your health plan

- Purchase health insurance or determine Medi-Cal eligibility through Covered California

- Stay on a parent's health plan until age 26

- Have no annual or lifetime dollar limits on essential healthcare benefits

- Have an advance directive to tell your doctor, family, and friends about the health care you want if you can no longer make decisions for yourself.

To learn more, visit the California Department of Managed Healthcare Your Health Care Rights webpage.

Get Involved

Sign up for Newsletter

To keep up with new developments related to medical debt, including programs and policies, resources, and news of community led activities and public and private efforts to address the problem, sign up to receive our Medical Debt in LA County newsletter.